Table of Content

The rates shown above are for loans from $50,000 to $99,999 for a borrower with a credit score of at least 730 and up to 70% loan-to-value ratio. To get the lowest rate, the bank also requires customers to make automatic payments from a U.S. The Home Equity Freedom Line of Credit permits borrowing up to 100% of the available equity in a primary residence within policy guidelines and excludes rental properties. During the ten year draw the member will have the flexibility to make the minimum interest only payment each month or add any principal amount they desire.

Monthly payments on a 5/1 ARM at 5.46 percent would cost about $565 for each $100,000 borrowed over the initial five years, but could increase by hundreds of dollars afterward, depending on the loan's terms. At the current average rate, you'll pay principal and interest of $638.66 for every $100k you borrow. Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

How to Establish Credit

One potential downside of a home equity loan is that if your property value goes down for any reason, you could end up underwater on your loan. This happens when the balance of your loan becomes higher than the value of your home. That's what happened to millions of Americans during the2008 financial crisis. Today, however, there's less risk of your home's value decreasing below your home equity loan amount.

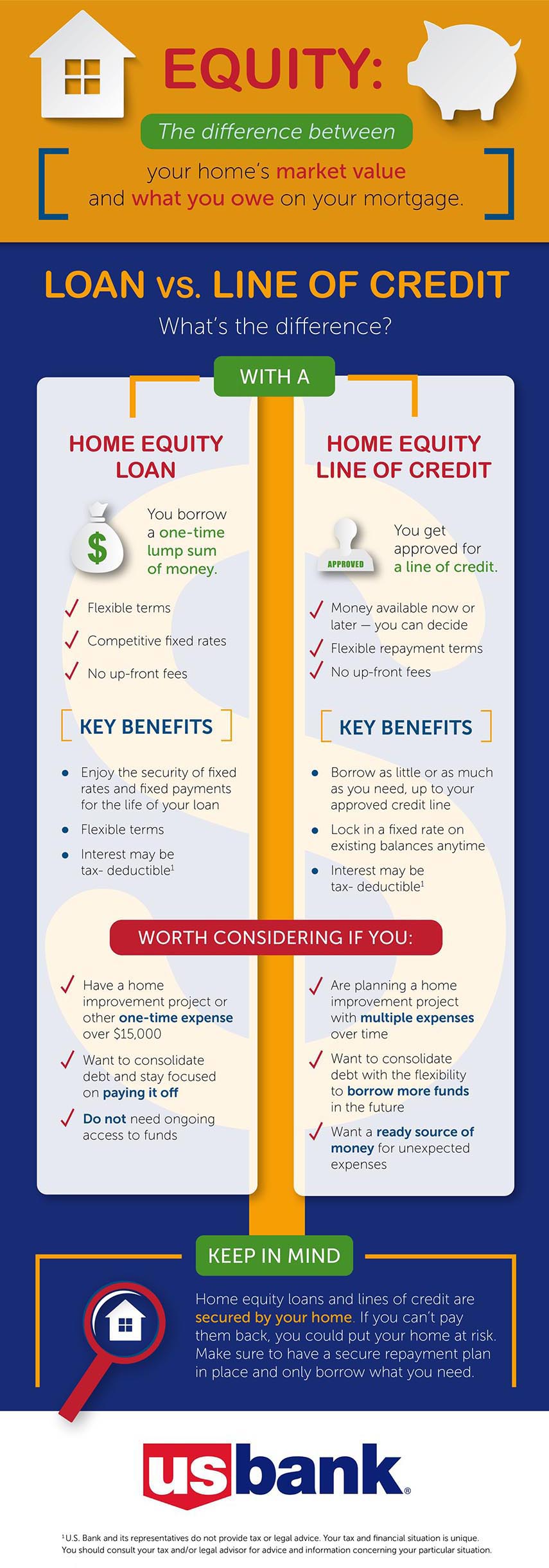

Home equity is the difference between what you owe on your mortgage and the current appraised value of your home. You build home equity by making consistent monthly mortgage payments over the years. To determine how much equity you have in your home, simply subtract your outstanding mortgage balance from the current appraised value of your home.

Here for a Home Equity Loan or Line of Credit?

Rates could be materially higher when the loan first adjusts, and thereafter. Serving those in the armed forces and their families, Navy Federal offers some of the best home equity loans available as fixed-rate loans or interest only loans. With interest only loans, you’re able to borrow up to 80% of your combined loan-to-value ratio .

Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. We are an independent, advertising-supported comparison service. The primary mortgage market is the market where borrowers can obtain a mortgage loan from a primary lender such as a bank or community bank.

How do I calculate how much equity is in my home?

The FHLBank of Indianapolis is committed to diversity and inclusion at all levels of the bank, from the employees we hire and promote to the programs, institutions, and businesses we support. The Federal Home Loan Bank of Indianapolis Vision is to be an agile and adaptive member- and community-focused bank. By following this link, you’re leaving GateCity.Bank to visit an external site. While this site has been known for being completely safe, please know that we’re ultimately not responsible for its content. You worked hard to find your home sweet home, so why delay that kitchen renovation, pool installation, college payment or long-awaited vacation another moment?

Compared to a shorter-term mortgage, such as 15 years, the 30-year mortgage offers more affordable monthly payments spread over time. With a home equity loan, you typically receive a one-time lump sum of money at a fixed interest rate that you then repay over time. With a home equity line of credit , the lender provides a credit line at a variable or floating interest rate that you can draw on as needed, up to an agreed-upon limit. Offering quality service for over 50 years, U.S. bank has some of the best home equity loans for borrowers with great credit.

What to make of current home equity interest rates?

Whether you’re looking to put down roots in your dream home or wanting to upgrade your ride, the best loan options with low rates live here. Trust, fiduciary, employee benefit plans and retirement services are offered through Northwest Bank’s Trust Department. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

It's important to carefully consider whether a home equity loan is right for you before applying for financing. Can provide funding for a fixed-rate mortgage portfolio or other loan type where the customer has an option to prepay the loan. At the average rate today for a jumbo loan, you'll pay principal and interest of $641.30 for every $100,000 you borrow.

Some banks, like Bank of America, will even give you a higher discount on your rate if you take out a certain amount of your line of credit. Using home equity to make home improvements can come with significant tax advantages. Since home equity loans offer lower interest rates than many student loans and credit cards, they can be a smart way to fund a college education, finance a wedding or consolidate high-interest debt. Equity Bank has also partnered with car corporations in the nation and a car loan seeker can look at the Equity bank Kenya car loans options and make the right decisions.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

TD Bank home equity loans are only available in about 16 states. If something unexpected has you struggling to make your repayments, get in touch. Whether you’re a first-time buyer or savvy investor, we’ve got the loan to get you that home. Enter the loan amount, interest rate, and the number of years for the term of the loan.

One option is to work with the lender that originated your first mortgage as you already have a relationship and history of on-time payments. Many banks and credit unions also offer discounted rates and other benefits when you become a customer. Adjustable-rate mortgages, or ARMs, are home loans that come with a floating interest rate. To put it another way, the interest rate can change periodically throughout the life of the loan, unlike fixed-rate mortgages. These types of loans are best for those who expect to refinance or sell before the first or second adjustment.

No comments:

Post a Comment